Fire Insurance

- Home

- General Insurance

- Fire Insurance

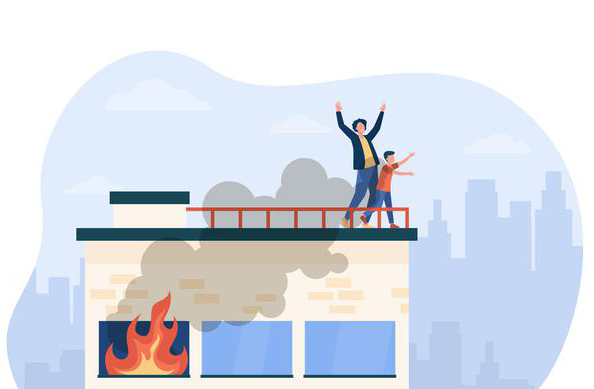

A fire has the potential to destroy a property or a business, leading to losses of great scale. To get compensated for such losses, you can opt for fire insurance, covering your movable and immovable property.

A fire insurance is an important part of a Property Insurance policy, that helps protect your residential, commercial or industrial properties such as apartment buildings, office spaces, shops and factories from any damages and losses that could occur due to a fire.

Standard Fire And Special Perils Insurance is a traditional cover that offers protection against fire and allied perils which are named in the policy. The policy can cover building (including plinth and foundation), plant and machinery, stocks, furniture, fixtures and fittings and other contents.

Some of the benefits of fire policy:

The standard policy covers the following perils:

Fire

Lightning

Explosion / Implosion

Aircraft Damage

Riot, Strike, Malicious Damages (RSMD)

Storm, Tempest, Cyclone, Typhoon, Hurricane, Tornado, flood, inundation (STFI)

Impact damage by any rail/ road/ vehicle/ animal (other than own)

Subsidence, Landslide and Rock slide

Missile Testing operations

Bush Fire

Bursting and/or overflowing of Water Tanks, Apparatus and Pipes

Leakage from Automatic Sprinkler Installations

The standard policy does not cover the following perils:

Willful acts or gross negligence

Forest Fire, War and Nuclear group of perils

Unspecified precious stones, cheques, currency, documents, etc. unless specifically declared

Terrorism

Underground fire

Loss because of theft during or after the fire

Malicious or hostile, human-made causes of fire

This list does not include all the exclusions as they vary for different providers.

In case of loss or damage, you need to follow these steps for making a claim:

Immediately inform the insurance provider

Contact the fire brigade and the police

Provide full cooperation to the insurance company appointed surveyor for scrutiny of the situation

Submit duly filled claim form and other proofs and photographs

Once approved, the claim can be settled from 15-30 days, depending on the respective insurer’s process

Our support team can help you get started on this journey right away